With the recent passage of the Inflation Reduction Act, the Federal Tax Credit for Solar Photovoltaics, also known as the Investment Tax Credit or ITC, was expanded in both amount and timeline. The ITC is a federal policy designed to incentivize the adoption of solar energy by providing a tax credit for a percentage of the cost of installing a solar energy system.

The ITC has played a crucial role in the growth of the solar industry in the United States of America. Under the expanded provisions, homeowners can now claim a higher percentage of their installation costs as a tax credit, which directly reduces the amount of federal income tax they owe. This tax credit gives homeowners alternatives to rising electricity costs and new ways to fight inflation, making solar energy more accessible and financially appealing.

The Federal Solar Investment Tax Credit Explained

To fully understand how the Federal Solar Investment Tax Credit works, it is best to understand and address what the IRA is and how it influences the provisions and incentives available for solar energy investments.

What is the IRA?

The Inflation Reduction Act (IRA) is a piece of legislation enacted by the United States Congress aimed at addressing inflation and its economic impacts. Introduced in 2022, the IRA encompasses a wide array of measures designed to reduce the federal budget deficit, curb inflationary pressures, and promote economic stability. Key components of the act include tax reforms, spending cuts, and investments in critical sectors such as healthcare, clean energy, and infrastructure. The IRA aims to balance the budget and reduce national debt by raising taxes on corporations and wealthy individuals while cutting government spending.

Additionally, the IRA places a strong emphasis on fostering sustainable economic growth through targeted investments. For instance, the act allocates substantial funding for renewable energy projects, energy efficiency initiatives, and the development of green technologies. These investments aim to reduce dependency on fossil fuels, create jobs in emerging industries, and promote long-term environmental sustainability, expanding on the overall goal of the ITC.

What is the ITC?

The Investment Tax Credit (ITC) was created in 2005 to encourage the use of solar energy by offering a 30% tax credit for installing solar panels on homes and businesses. This helped reduce initial costs and boost solar energy adoption. Over time, the ITC has been extended and modified, with notable changes in 2015 extending the 30% credit through 2019 and gradually reducing it afterward. For residential systems, the credit drops to zero after 2034. The ITC, a non-refundable dollar-for-dollar reduction in federal income taxes, can be claimed in the year the system is installed, significantly boosting solar investments, job creation, and cleaner energy use. For instance, if you owe $5,000 in federal taxes and claim a $4,000 solar tax credit, your tax bill would be reduced to $1,000.

The extension of the timeline for the ITC ensures more homeowners and businesses can take advantage of this benefit, promoting long-term investment in renewable energy infrastructure. It is also the most recent update in a long history of saving American’s money.

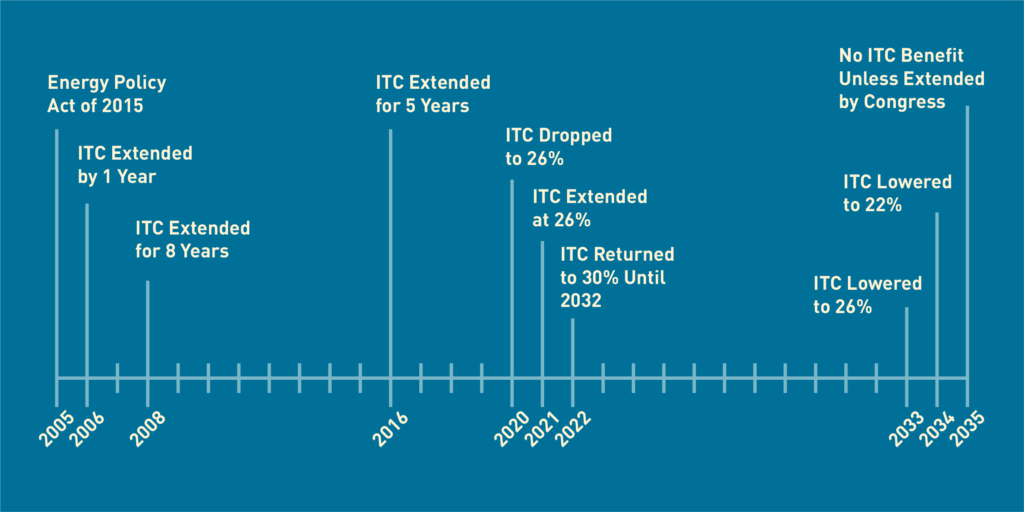

Here’s a Timeline of the ITC Over the Past Few Decades:

2005: The Energy Policy Act of 2015, authorized under sections 25D and 48 of the US tax code, first created the 30% tax credit for residential and commercial solar energy projects. It was set to expire in 2006.

2006: The ITC was extended for one additional year by the Tax Relief and Health Care Act of 2006.

2008: The Emergency Economic Stabilization Act of 2008 extended the ITC for eight years and eliminated the previous $2,000 cap for residential solar panel systems.

2016–2019: The ITC was extended again for another five years in early 2016 with the Consolidated Appropriations Act of 2016. This extension introduced a step-down approach to the benefit for the eventual sunset of the credit, but for these first few years, the benefit stayed at 30%.

2020–2021: Based on the phase-down percentage introduced in the Consolidated Appropriations Act of 2016, the ITC dropped to 26% in 2020 and was scheduled to drop to 22% in 2021 before Congress extended the ITC at 26% for solar systems installed 2021 with the Better Energy Storage Technology (BEST) Act of 2020.

2022–2032: The ITC dropped to 26% in 2022 until President Biden signed the Inflation Reduction Act of 2022, which bumped the ITC back to 30% and extended it to solar systems installed between 2022 and 2032, after which the ITC will be phased out.

2033: Owners of new residential solar systems installed in 2033 will be entitled to a 26% ITC benefit.

2034: Owners of new residential solar installed in 2034 will be entitled to a 22% ITC benefit.

2035: Unless extended by Congress, there will be no ITC benefit for residential solar installed after 2034.

ITC Qualification: What Meets the Criteria?

The ITC applies to different expenses associated with solar panel system installation, from the solar panels themselves to the assembly and installation costs.

The following qualifies:

- Solar photovoltaic (PV) panels and cells: The primary component of the solar energy system, converting sunlight into electricity.

- System equipment like mounting, wiring, and inverters: Includes mounting hardware to secure the rooftop solar panels, wiring to connect the solar panel system, and inverters to convert the generated direct current (DC) electricity into alternating current (AC) usable by home appliances.

- Installation: The labor costs for on-site preparation, assembly, and installation of the solar panel system.

- Permitting and inspection: Fees paid to local governments for the necessary permits and inspections to ensure the solar system meets all regulations and safety standards.

- Interconnection: Costs associated with connecting the solar panel system to the public utility grid, allowing for net metering where excess generated electricity can be fed back into the utility grid.

- Energy storage devices (e.g., batteries): Includes the purchase and installation of solar batteries designed to store the electricity generated by the solar panel system for use when sunlight is not available or during off-peak hours.

- Sales tax on eligible expenses: Any sales tax paid on the eligible components, equipment, and services related to the solar system installation.

Batteries can be claimed for tax credit if they are purchased or installed a year or more after installing the rooftop solar panel system.

How Do Other Incentives Affect the Federal Investment Solar Tax Credit?

In addition to the federal investment solar tax credit, several states offer solar incentives, rebates, and credits. A few common incentives include tax credits, subsidized loans, rebates, and solar renewable energy certificates (SREC’s). However, each state’s solar incentives vary. Here’s a look at a few of the most common:

State Tax Credits

Most state solar tax credits work similarly to the ITC—dollar-for-dollar reduction of the taxes you owe. Eligibility and benefit amounts vary widely by state and generally don’t impact your federal solar incentives.

State Government Rebates

Several states and utility companies offer limited-time rebates for installing a solar panel system on your home. These programs often offer an upfront payment of 10% to 20% of the cost of installing a new photovoltaic (PV) system. However, these rebates are typically time-bound, making it important for you to do your research and get your paperwork submitted before the state program ends.

Shop Renewable Energy Certificates

In some states, the amount of energy your solar system generates can be converted to renewable energy certificate (SREC) that can be offered to regulators and environmentally conscious organizations to meet their commitment to clean energy and environmental stewardship. Generally, for every 1,000-kilowatt hour of electricity your solar system generates, you’ll earn one SREC. The monetary value of SRECs changes over time and depends on supply and demand and the existence of a SREC market in your area.

Browse the Database of State Incentives for Renewables & Efficiency to discover the solar incentives available to you and to gain insights into solar products, technologies, and installation.

The ITC is Applicable to You

The Inflation Reduction Act (IRA) and the Investment Tax Credit (ITC) are pivotal U.S. legislative measures designed to stimulate investment in renewable energy and combat climate change. The ITC incentivizes solar energy investments by allowing a significant tax credit for solar installations. Initially, it provided a 30% tax credit for solar systems on residential and commercial properties, spurring significant growth in the solar industry. Over time, the ITC’s terms have evolved, with extensions and phased reductions to gradually taper the incentive. The IRA, enacted in 2022, aimed to bolster the U.S. economy post-pandemic while addressing climate issues. Among its numerous provisions, the IRA includes enhancements to the ITC, extending and expanding the credit to include other clean energy technologies and storage solutions, reflecting a broader commitment to renewable energy development and sustainability.

Blue Raven Solar Can Help You Save

The expansion of the Investment Tax Credit (ITC) through the Inflation Reduction Act encourages the adoption of solar energy by increasing the financial benefits for homeowners. By offering a 30% tax credit for solar installations, the ITC significantly reduces the upfront cost of solar systems, making renewable energy more accessible to a broader range of people. This expansion also supports the growth of the solar industry, creating jobs and fostering innovation in clean energy technologies.

Blue Raven Solar can help you maximize these solar benefits, helping you save money and reducing your overall energy costs. Our experts can guide you through the solar installation process, allowing you to get the most out of your solar investment, effectively leveraging the Investment Tax Credit (ITC) to enhance your savings.

Sorry, the comment form is closed at this time.